Category - Stops

One of the positive aspects of the present-day overload of information available on the internet is that it levels the playing field to a certain degree amongst private investors. Buying or selling shares can be done online instantly and there are plenty of mechanisms to help traders mitigate the risks inherent in the market and those specific to individual stocks and derivative products.

Like most other financial products traded on margin there are a number of risks in buying and selling contracts for differences. Risk management will play an important role in any successful trading plan. However, you still need to be ready to take responsibility for the stock market trades that you make, irrespective if they are profitable or not. The fact that CFDs are traded on margin means that the initial investment magnifies your potential gain or loss. Risk is generally inherently linked to reward, the riskier the investment, the higher the possible returns, however if risk is managed properly it can be considerably reduced. When trading contracts for difference this is done principally with the utilisation of position sizing, stop loss orders and straightforward portfolio hedging.

Another vital area is the risk management. Risk management plays such a important role in trading success because it allows you to protect your capital. It is important to appreciate as early as possible that losing trades are an inevitable part of trading. The availability of stop loss and guaranteed stop orders are useful tools allowing you to reduce the dangers associated with adverse price movements as they allow you to open or close positions if pre-set levels are reached thereby limiting lossing and locking-in profits in the process. If you aren’t familiar with the different order types and their application, though, it’s going to be very difficult for you to trade with confidence. Once you get to know your order types, you can focus all your time and energy on your trading strategy and execution. CFD providers will usually offer you a wide selection of order types including normal stop loss orders, trailing stops and guaranteed stops which allow you to manage existing open positions much more easily and proactively.

Learning the basics of trading CFDs is relatively simple but if a trader really wants to maximize potential profits and take full advantage of market movements then it is important to explore the different order types that most providers will allow you to implement. There are obvious advantages for placing orders rather than trading at the current market price, these include the ability to try and obtain a better entry/exit price and also being able to trade with a pre-determined strategy rather than just reacting to the current short term market movements.

Protect your position with order types -:

— A market order allows you to buy a CFD at the prevailing price. Here, you are simply placing an order from the chart, dashboard or quoteboard at the market price. Market orders practically guarantee that your full order will be filled, but not the price at which it will be filled. If you want a trade that will be filled at the best available price – for instance, some important news about a company has been released that will affect the stock price and you want in — A limit order allows you to place an instruction to buy (or sell) at a lower (or higher) price than the market is presently trading at. When the market hits your price, the order is triggered. Limit orders are usually used to exit a trade at a profit. CFD traders may also want to utilise these types of orders when they are on the sidelines waiting for stock prices to move close to a support or resistance level before taking a position. If aiming to lock-in gains on a short position, a limit order to buy would be placed at a level below current market prices.

— A stop order enables you to close a CFD position below the current market price and is the main means stock market traders use to manage risk on each trade that they take out. i.e. Stop loss orders are located at a level that’s worse than prices currently obtainable in the market. On a long CFD trade, the stop loss level to sell would be placed below the current market price.

— Other online order types include if-done orders and one cancels other orders.. The types of orders available will depend on the CFD broker that you use, but usually these more advanced order types allow you to link different order types together to execute more of your trading strategy in one go. Here you are basically setting up an entire trade start to finish: when to get in and when to get out.

— Good till cancelled. is an additional ruling to a simple day order, GTC means that the order will keep running until either the price level is reached and filled or the order is cancelled.

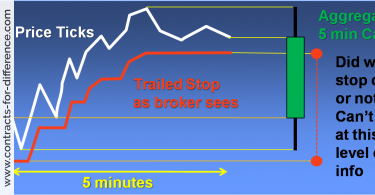

— Trailing stops. Here you set your stop to trail the market price to help capture additional profits while minimising losses.

— Scale-out orders. allow you to exit the market in fractions of your original order. Like a parent and contingent order, you can set up an entire trade, but the order is applied if you’re trading more than one contract.

— Guaranteed stops. Most orders do not guarantee that your position is exited at the exact level you initially specified.. For an extra fee, this type of order guarantees execution at your specified price. (However, note that this order type is only available on market maker platforms and remember to check your market before you use this type of order as it may not be available for all markets)