I’ve mentioned retracements and bouncing before, and you should know what I mean, if not from your reading, then from the idea conveyed in those words. But specifically, here’s a reminder of what I mean by them –

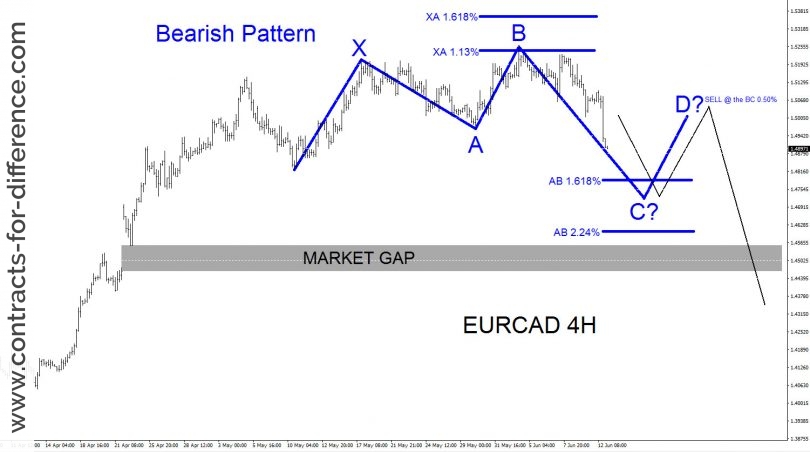

Bouncing is what we hope the stock price is going to do, going back where it just came from. The same idea applies also to retracement, which is very similar. What you should be looking for, if you want to find a bounce/retrace candidate, is a stock that is oversold or overbought, near its support or resistance line, and you get a reversal candlestick, suggesting that the current move is going to change direction. What I’m really saying is this is another way of looking at the support and resistance lines, and you should look for other indicators to confirm your ideas.

At this stage, you can go with your gut, if you have a good gut, or you can wait for a second signal, which might be a candle or an upturn in momentum. You’ve then got your long or short candidate (depending which way you are following it). You can use the Fibonacci tool to find your target to get out of the trade, which may be 50%, or maybe 38.2% for a long move. You can check what has happened previously to see what level you can expect.