One Cancels the Other Order (OCO) is an extremely useful device which allows you to program your trading, and goes a step beyond the Parent and Contingent Order. This is an advanced type of order which links two orders. In this instance the execution of the first order will mean the automatic cancellation of the other order linked to it. Often, although not always, the OCO order consists of a stop loss and a limit order placed on either side of the prevailing market price. As soon as one is executed, the other one will be cancelled.

These orders may be beneficial to those traders with time constraints or who want to limit their risk. With an OCO order, the orders for your stop loss and take profit levels are taken simultaneously, such that you have your risk and reward defined. If one of these levels is hit, the other order is automatically cancelled. An OCO order is very similar to if done orders but this type of order is placed during the running of an existing trade. The mechanics of this order is to leave a stop loss order and a take profit limit order. If one order is hit and the trade executed then the other pending order will be cancelled i.e.’one cancels other’.

For example, with a long position a stop loss order would be placed below the market to limit the loss, and a limit order would be placed above the market to close the trade for a profit. If the trade becomes a loss, the stop loss will be triggered and the limit order cancelled; if the price rises to the limit, the position is liquidated for a profit and the stop loss order goes away. Some providers even offer variations on this order, such as One Triggers a One Cancels the Other Order (OT/OCO). An example of using this would be if you saw the possibility of a breakout in a range trading financial security.

In this case, you would place a buy stop order above the resistance level, as the start of the OT/OCO order. This would have the effect of buying the security if it broke out through the resistance. When this order is filled, it triggers the OCO order, which would include a stop loss order just below the resistance level in case the breakout failed, and a stop limit order at the target price, which might typically be the height of the range above the resistance. Either way, when one of these stop orders is fulfilled the other order is cancelled, so either you cut your losses if the breakout retraces, or you capture your profits if it performs as expected. This type of order is sometimes known as a bracket order.

Examples of OCO Orders

The One Cancels the Other order (OCO) is quite similar to using limit orders. These orders may be beneficial to those traders with time constraints or who want to limit their risk. With an OCO order, the orders for your stop loss and take profit levels are taken simultaneously, such that you have your risk and reward defined. If one of these levels is hit, the other order is automatically cancelled.

ABC stock is trading at $19.00 and you have a long CFD position at $18.75. You want to take profit if the price goes up to $19.50 and but you also want to be stopped out should the price go down to $18.50. You can place an OCO order: ‘Sell ABC stock @ $19.50 on limit OCO $18.50 on stop’.

Let’s take another OCO order example. Let’s say you are long on a share CFD at £15, since you are in the market, you can make an OCO order. Suppose you set a take profit level of £15.90 while simultaneously setting the stop loss at £14.60. If the price rises and the sell order at £15.90 is executed, the other sell order at £14.60 is cancelled, hence ‘One Cancels the Other’. This allows investors to trade CFDs efficiently, taking profits in a breakout or cutting losses if the price retraces.

As you can see, this is almost automatic trading, and all you have to do is decide on the price levels that you want to insert. But even this does not fully exploit the power of the One Cancels the Other Order. Say you have only limited funds, and you are interested in two different financial securities that are approaching a good setup position. You could split your account between them, but if you want to invest in one or the other and don’t have time to watch the markets, you could also use the OCO order.

All you need to is issue an OCO order to buy a number of shares in security A at a limit price, or to buy a different number of shares in security B at a different limit price, working out in each case how many shares you can afford to buy with the funds available. The effect of this is that you buy either A or B, depending which one meets your conditions first, and when that order is filled the other order is cancelled automatically so that you do not overspend. As you may not know which if either of these securities is going to breakout or start trending, this gives you a much improved chance of getting into a profitable trade without over committing yourself.

Finally, even this does not express all the options, as some brokers allow you to place a One Cancels All (OCA) type of order. This allows you to submit more than two orders simultaneously, and if any of them is filled all the others are cancelled.

When are OCO Orders Useful?

OCO orders are also useful if you do not have time to constantly watch charts and react to the market as the price action unfolds. You could just use an OCO order so that your reaction to a certain event or price area is pre-determined. This allows traders to take advantage of opportunities automatically. One good way is to use support and resistance levels. If there is a strong downward trend and you think the price will keep pushing lower, you could request a buy order well below the support level and a buy order above the support level with an OCO order when in a short position. This way, you can wait and see if the trade moves in your favour or not without monitoring the price and worrying about the risk of your trade.

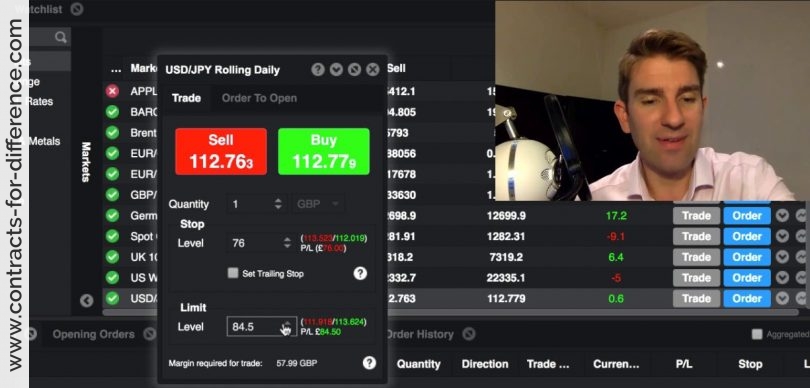

Another good technique to use with OCO orders is Fibonacci retracements. When the price of an asset rallies, there is always a retracement and the Fibonacci retracement levels can be incorporated with OCO orders. These retracement levels are good targets as many traders watch these levels and Fibonacci sequences are found many natural phenomenon, such as herd behaviour. The chart below shows the USD/JPY rate. After posting a high, Fibonacci retracement analysis can be used to see if there is a trend reversal or retracement. OCO orders can be used. In the chart below, the retracement levels are shown. Suppose we think the trend will reverse and enter a short position with a CFD. Then an OCO order can be placed. Suppose you enter once the price closes below 118.328, the 61.8% retracement at 118.257. Then you can use an OCO order to stop loss at the 76.4% retracement at 118.551 and a take profit at 117.745, the 23.6% retracement. The graph shows the price moved further and eventually hit the 23.6% retracement level at 117.745. In this case, the buy order at 117.745 would be executed, while the buy order at 118.551 will be cancelled.